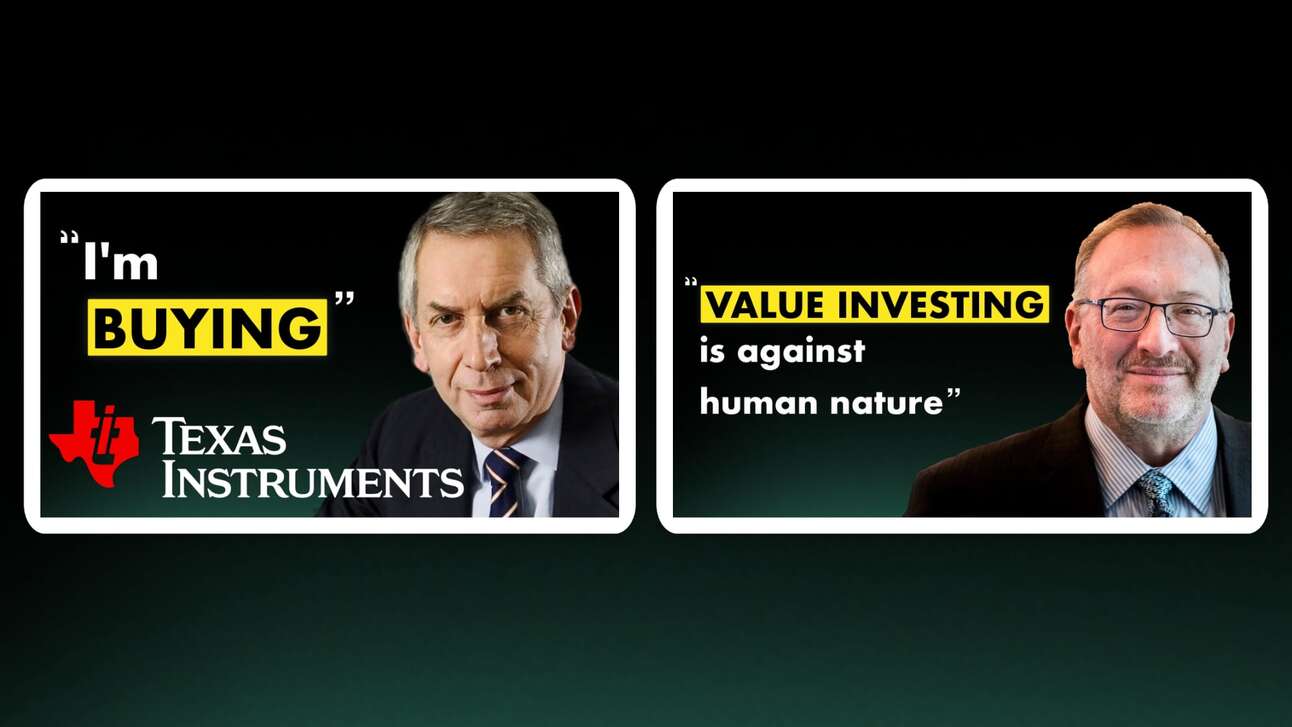

When two of the world's most successful investors make bold moves, smart money pays attention. Terry Smith just increased his Texas Instruments stake by over 60%, while Seth Klarman's investment wisdom continues to generate billions in returns through principles most investors ignore. What do these legends see that the market is missing?

In this comprehensive analysis, we decode the strategies behind their success. Discover why Smith is betting big on a semiconductor giant with concerning debt levels, and learn the five timeless lessons that have made Klarman one of the most respected value investors alive.

Why is Terry Smith Buying Texas Instruments?

Discover why legendary investor Terry Smith just increased his Texas Instruments position by 60.2% in our comprehensive 7-step analysis. We dive deep into TXN's financials, examining their impressive 38.5% profit margins, massive share buyback program, and recent $1.61 billion CHIPS Act funding.

But there's a concerning trend that has me worried about this semiconductor giant - their debt levels are rising fast and it would take them almost 9 years to pay it off. Is Terry Smith making a brilliant contrarian bet, or is this expensive stock a value trap?

We break down the complete investment case, including our DCF valuation. Plus, we reveal how Texas Instruments compares to other semiconductor stocks in our rankings and whether the recent government support can justify the premium valuation. This is essential viewing for anyone considering semiconductor investments in 2025.

5 Timeless Money Lessons from Seth Klarman

Discover the timeless investment wisdom of Seth Klarman, the legendary value investor who manages over $27 billion at Baupost Group. Despite his success, Klarman rarely gives interviews or public lectures, making his insights incredibly valuable.

In this video, I've compiled everything I could find from his rare appearances to share his 5 most important money lessons that every investor needs to know. Learn why being a contrarian is essential for value investing success, how to develop the patience needed for long-term wealth building, why investing is a marathon not a sprint, the truth about timing the market, and how these principles apply even when investing in ETFs.

Whether you're a beginner or experienced investor, Klarman's philosophy on thinking differently from the crowd, managing emotions, and focusing on price over popularity will transform your approach to building wealth. These aren't just investment tips – they're character-building lessons that separate successful investors from the rest.

Get even more value from Bald Investor

Stock Investing Academy - Learn how to make your money work for you

Stock Ranking Pro - Find the best investment opportunities

Smart Money Portfolios - Follow the smart money with beautiful visual clarity

Intrinsic Value Calculators - Value any company with ease

Bald Investor YouTube Channel - More quality investment videos

Bald Investor Bookshop - Great Books for Investors

Save money with these deals!

👉 SHARESIGHT (4 Months FREE)

👉 SEEKING ALPHA ($30 OFF)

👉 ALPHA PICKS ($50 OFF)

👉 SEEKING ALPHA + ALPHA PICKS BUNDLE ($159 OFF)

👉 FORECASTER (10% OFF with code: Bald10)